What’s in this Article?

- Table of Contents

- Why in the news

- Eligibility as Resolution Applicants

- Investment Opportunities

- About Asset Reconstruction Companies (ARC)

- Origin of ARCs in India

- Function of Asset Reconstruction Companies (ARCs)

- Resolution Strategies that an ARC Can Adopt

- The primary sources of funds for an ARC

- How do ARCs work?

- Some key challenges faced by ARCs:

Why in the news?

- The Reserve Bank of India (RBI) released a master direction for Asset Reconstruction Companies (ARCs), saying the guidelines be effective from April 24,

- ARCs are expected to have a minimum capital requirement of Rs 300 crore, compared to Rs 100 crore as on October 11,

- Existing ARCs have been provided a glide path to achieve the minimum required Net Owned Fund (NOF) of Rs 300 crore as on March 31,

- “In case of non-compliance at any of the above stages, the non-complying ARC shall be subject to supervisory action, including prohibition on undertaking incremental business till it reaches the required minimum NOF applicable at that time,” said the RBI.

Eligibility as Resolution Applicants

- Asset Reconstruction Companies (ARCs) possessing a net owned fund (NOF) of at least Rs 1000 crore are authorized to participate as resolution applicants in the asset resolution proceedings governed by the Insolvency and Bankruptcy Code of 2016 (IBC).

Investment Opportunities

- Asset Reconstruction Companies (ARCs) have the opportunity to allocate funds into various avenues such as government securities, deposits with scheduled commercial banks, the Small Industries Development Bank of India (SIDBI), the National Bank for Agriculture and Rural Development (NABARD), or other entities designated by the central bank.

- Moreover, ARCs are permitted to venture into short-term investments like money market mutual funds, certificates of deposit, and corporate bonds/commercial papers with a short-term rating of AA- or higher by a qualified credit rating agency.

- However, there exists a restriction wherein the maximum investment in such short-term instruments is limited to 10% of the Net Owned Funds (NOF).

About Asset Reconstruction Companies (ARC)

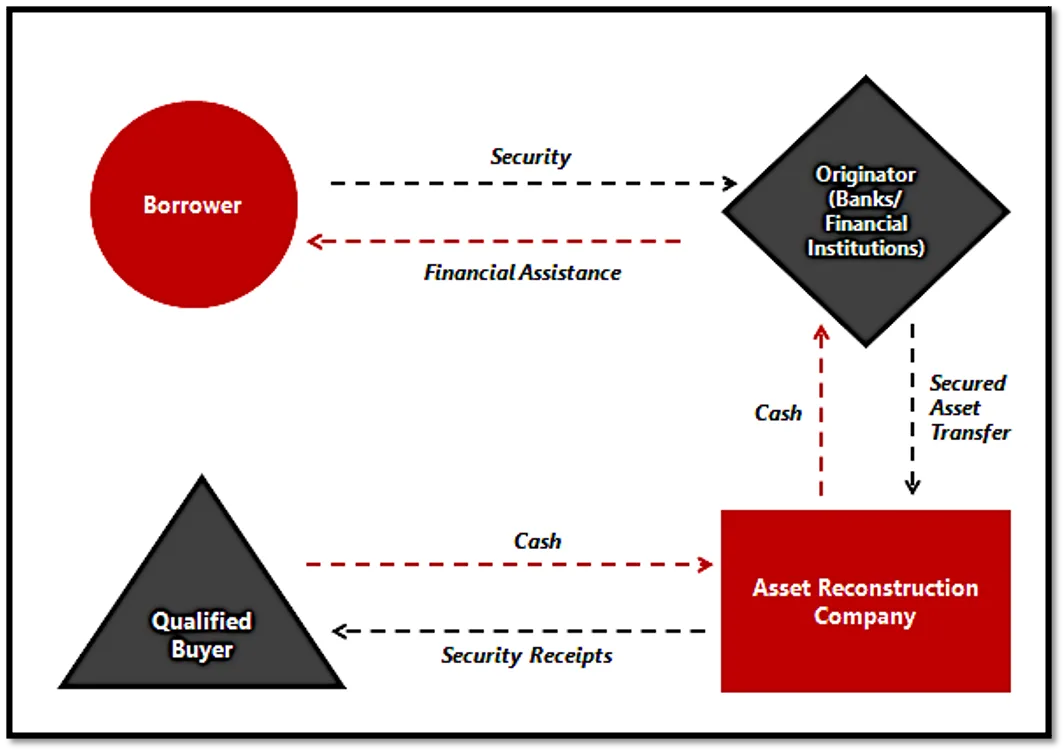

- ARCs, financial entities, purchase Non-Performing Assets (NPAs) or problematic assets from banks and financial institutions, enabling these institutions to improve their balance sheets.

- They operate within the regulatory framework outlined in the Companies Act of 2013 and are registered with the Reserve Bank of India under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act of

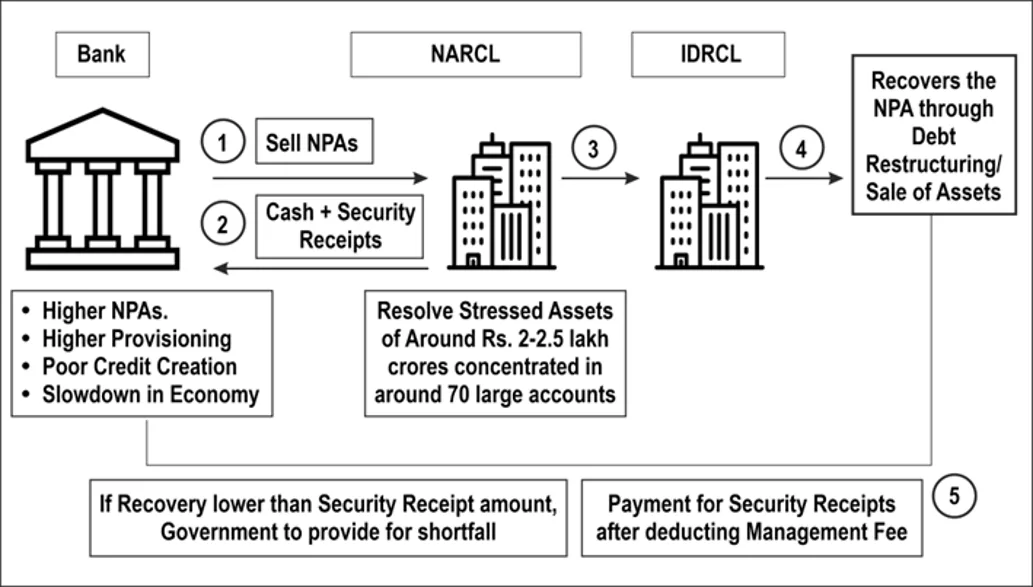

- As: National Asset Reconstruction Company Limited (NARCL) has been formed by banks to pool and merge distressed assets for future resolution. It is predominantly owned by Public Sector Banks (PSBs) with a majority share of 51%.

- India Debt Resolution Company Ltd. (IDRCL) is another organization tasked with marketing the distressed assets in the market subsequently.

- PSBs and Public Financial Institutes (FIs) will have a maximum ownership of 49% in IDRCL, while the remaining 51% will be held by private-sector lenders.

Origin of ARCs in India

- An outline detailing the origin of Asset Reconstruction Companies (ARCs) in India:

- Pre-Liberalization Era (Pre-1991):

- Before economic liberalization, there was no specific framework for dealing with distressed assets in India.

- Banks typically dealt with non-performing assets (NPAs) through traditional methods such as loan restructuring, rescheduling, or recovery through legal means.

- Post-Liberalization Period (1991 onwards):

- With economic reforms in the early 1990s, there was a recognition of the need for a specialized mechanism to address the issue of rising NPAs in the banking sector.

- The Narasimham Committee Report (1991) highlighted the need for asset reconstruction companies to handle NPAs efficiently.

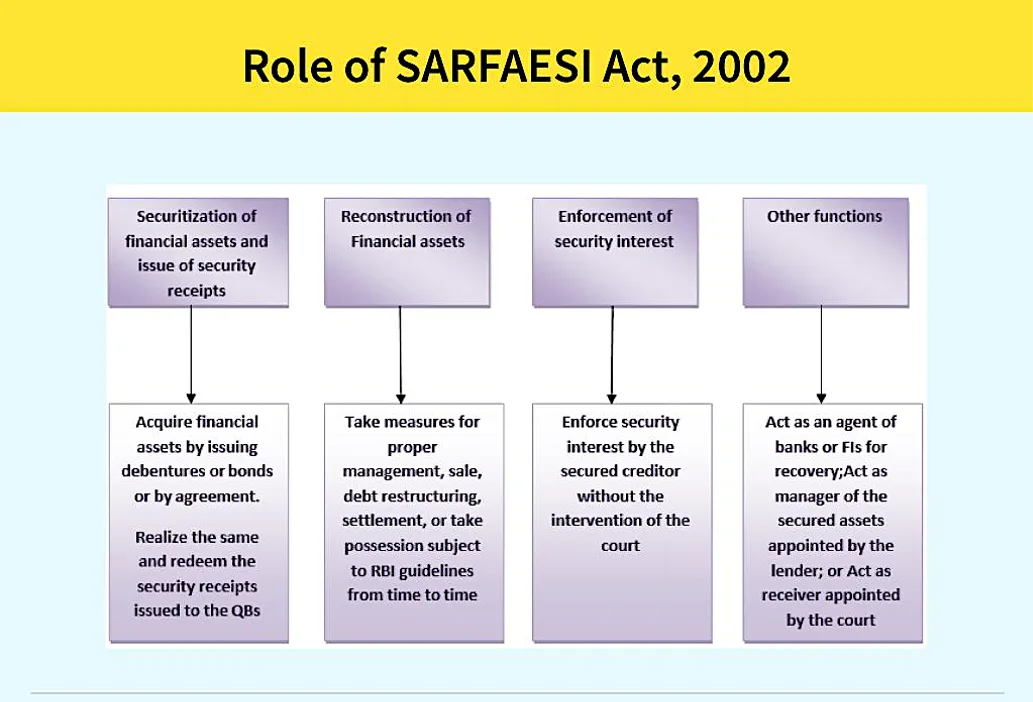

Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002:

- The SARFAESI Act provided a legal framework for the establishment and functioning of ARCs in India.

- It empowered banks and financial institutions to enforce security interests in NPAs without the intervention of courts.

- ARCs were authorized to acquire distressed assets from banks and financial institutions and take measures for their resolution.

Regulatory Framework:

- The Reserve Bank of India (RBI) issued guidelines for the registration and regulation of ARCs in 2003, providing a regulatory framework for their operations.

- ARCs were required to comply with capital adequacy norms, asset classification norms, and reporting requirements prescribed by the RBI.

Formation of First ARCs:

- Following the regulatory framework, the first ARCs were established in India, such as Asset Reconstruction Company (India) Limited (ARCIL) in 2002 and others subsequently.

- These ARCs began acquiring distressed assets from banks and financial institutions, aiming to resolve them through various strategies such as debt restructuring, asset sale, or management takeover.

First ARCs Established (2003-2004):

- The first Asset Reconstruction Companies were established in India shortly after the introduction of the SARFAESI Act.

- These companies were given licenses by the RBI to acquire distressed assets from banks and financial institutions.

Amendments and Refinements:

- Over the years, the regulatory framework for ARCs in India has been refined and amended to address various operational and regulatory challenges.

- The RBI has periodically issued guidelines to enhance transparency, corporate governance, and the effectiveness of ARCs.

ARC Regulations (2017):

- In 2017, the RBI issued comprehensive regulations for ARCs, known as the “Asset Reconstruction Companies (Reserve Bank) Guidelines, ”

- These regulations set detailed guidelines for capital adequacy, governance, risk management, and other aspects of ARC operations.

Function of Asset Reconstruction Companies (ARCs)

- The function of Asset Reconstruction Companies (ARCs) primarily revolves around the acquisition and resolution of distressed assets.

- Acquisition of Distressed Assets: ARCs acquire non-performing assets (NPAs) and distressed assets from banks and financial institutions. These assets may include bad loans, stressed loans, or assets that have turned non-performing.

- Resolution of Distressed Assets:

- ARCs specialize in resolving distressed assets through various means, including debt restructuring, asset sale, or management takeover.

- They analyze the financial position of the borrower and the underlying collateral to devise the most suitable resolution strategy.

- Rehabilitation of Borrowers:

- ARCs may attempt to rehabilitate the borrower entities by restructuring their debt, infusing fresh capital, or assisting in the revival of the business operations.

- The aim is to help the borrower overcome financial distress and become viable again.

- Asset Reconstruction:

- If rehabilitation is not feasible, ARCs may take over the management of the distressed assets and work towards their reconstruction.

- This may involve selling off unproductive assets, restructuring the organization, or renegotiating terms with creditors.

- Debt Recovery:

- ARCs focus on recovering as much value as possible from the distressed assets to maximize returns for the investors.

- They employ strategies such as asset monetization, debt recovery proceedings, or settlements with borrowers to realize the value of the assets.

- Asset Management:

- ARCs manage the acquired distressed assets throughout the resolution process, ensuring compliance with regulatory requirements and optimizing asset performance.

- They may engage in active management of the assets, including monitoring cash flows, mitigating risks, and pursuing legal remedies if necessary.

- Facilitation of Stakeholder Communication:

- ARCs act as intermediaries between banks, financial institutions, borrowers, and other stakeholders involved in the resolution process.

- They facilitate communication and negotiation among the parties to achieve consensus on resolution strategies and outcomes.

- Compliance and Reporting:

- ARCs are required to adhere to regulatory guidelines and reporting standards set forth by the regulatory authorities.

- They must maintain transparency in their operations, financial disclosures, and compliance with asset classification norms and provisioning requirements.

- Overall, ARCs play a vital role in the financial ecosystem by helping banks clean up their balance sheets, promoting credit discipline, and contributing to the efficient resolution of distressed assets.

Resolution Strategies that an ARC Can Adopt

- An ARC can employ several resolution strategies to address distressed assets:

- Debt Restructuring: Renegotiating the terms of the loan to make it more manageable for the borrower.

- Asset Sale: Selling the distressed assets to recover as much value as possible.

- Management Takeover: Assuming control of the distressed company to implement turnaround measures.

- Debt-for-Equity Swap: Converting debt into equity ownership in the borrower company.

- One-time Settlement: Negotiating a settlement with the borrower for a reduced amount to close the debt.

- Merger or Acquisition: Facilitating the merger or acquisition of the distressed company with a financially stronger entity.

- Liquidation: In extreme cases, liquidating the assets of the distressed company to repay creditors.

- Each strategy is chosen based on the specific circumstances of the distressed asset and aims to maximize recovery for the stakeholders involved.

The primary sources of funds for an ARC

- Equity Capital: Initial capital contributed by promoters, investors, or financial institutions to establish the ARC.

- Borrowings: Funds raised through loans or lines of credit from banks, financial institutions, or capital markets.

- Security Receipts (SRs): Issuance of security receipts to the banks or financial institutions against the distressed assets acquired by the ARC. These receipts represent the value of the assets and are redeemable over time.

- Asset Management Fees: Fees charged by the ARC for managing and resolving distressed assets on behalf of banks and financial institutions.

- Investment Income: Returns generated from the resolution and recovery of distressed assets, including interest income, dividends, or proceeds from asset sales.

- Public Offerings: Fundraising through public offerings of equity or debt securities in the capital markets.

- Strategic Partnerships: Collaboration with strategic investors, private equity firms, or international financial institutions for funding support or co-investment opportunities.

- By diversifying funding sources, ARCs can ensure sufficient liquidity to acquire and resolve distressed assets effectively.

How do ARCs work?

- ARCs work by acquiring distressed assets from banks and financial institutions and then employing various strategies to resolve them:

- Acquisition: ARCs purchase non-performing loans or distressed assets from banks at a discounted price.

- Resolution: They assess the assets and devise strategies such as debt restructuring, asset sale, or management takeover to maximize recovery.

- Rehabilitation: ARCs may attempt to rehabilitate the borrower entities by restructuring debt or providing financial support to revive their operations.

- Asset Management: They actively manage the acquired assets, monitor cash flows, mitigate risks, and pursue legal remedies if necessary.

- Recovery: ARCs focus on recovering as much value as possible from the distressed assets through asset monetization, debt recovery proceedings, or settlements with borrowers.

- Return to Investors: Once the assets are resolved and funds are recovered, ARCs distribute the proceeds to the investors, including banks, financial institutions, and themselves.

- By facilitating the resolution of distressed assets, ARCs help banks clean up their balance sheets, promote financial stability, and contribute to the efficient functioning of the financial system.

Some key challenges faced by ARCs:

- Asset Quality and Valuation: Difficulty in accurately valuing distressed assets due to complex financial structures, inadequate information, and uncertain market conditions.

- Capital Constraints: Limited capital availability for acquiring distressed assets, which can restrict the scale of operations and resolution efforts.

- Legal and Regulatory Hurdles: Legal complexities and delays in debt recovery proceedings, enforcement of security interests, and resolution of disputes with borrowers.

- Asset-Liability Mismatch: Mismatch between the duration of acquired distressed assets and the repayment obligations of funding sources, leading to liquidity and refinancing risks.

- Operational Efficiency: Operational challenges in managing a large portfolio of distressed assets, including asset recovery, restructuring, and ongoing management.

- Market Dynamics: Fluctuations in asset prices, interest rates, and economic conditions can impact the profitability and viability of resolution strategies.

- Competition: Increasing competition among ARCs for acquiring distressed assets, leading to higher acquisition costs and reduced margins.

- Corporate Governance: Ensuring transparency, accountability, and good corporate governance practices in the management and operations of ARCs.

- Addressing these challenges requires a combination of regulatory reforms, operational improvements, risk management strategies, and collaboration with stakeholders in the financial ecosystem.

Disclaimer: The article may contain information pertaining to prior academic years; for further information, visit the exam’s “official or concerned website“.