What’s in this Article?

- Table of Contents

- Why in the news?

- What is Inheritance Tax?

- History of Inheritance Tax in India

- Status of inheritance tax in India

- When should the person receiving the inheritance pay tax?

- Need for an inheritance tax in India

- Global Comparison

Why in the news?

- Amidst the political uproar surrounding ‘inheritance tax’ in India, an old video featuring Nikhil Kamath, co-founder of Zerodha, where he is discussing the issue with Mint, has surfaced.

- In the video, Kamath expresses his support for inheritance tax in India. “When wealth is passed down from one generation to another, there needs to be a mechanism in place to redistribute a portion of it. Inheritance tax has ample precedence,” Kamath stated in this conversation with Mint.

#Image Credit: Mint

What is Inheritance Tax?

- International tax law distinguishes between an estate tax and an inheritance tax.

- An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

- However, this distinction is not always observed; for example, the UK’s “inheritance tax” is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax.

- For historical reasons, the term death duty is still used colloquially (though not legally) in the UK and some Commonwealth countries. For political, statutory and other reasons, the term death tax is sometimes used to refer to estate tax in the United States.

History of Inheritance Tax in India

- In India, the history of inheritance tax can be traced back to the Estate Duty Act of This act was introduced with the aim of reducing economic disparity by imposing taxes on the transfer of wealth from one generation to another. Under this act, estate duty rates were progressive, meaning they increased with the value of the estate being transferred. The highest rate reached as much as 85 percent for estates exceeding Rs 20 lakh.

- The estate duty was applicable not only to immovable properties within India but also to movable assets, whether they were located within the country or abroad. This broad scope aimed to ensure that all significant assets were subject to taxation upon the death of an individual.

- To prevent tax avoidance, the law included provisions to tackle certain transactions that could be used to circumvent the estate duty. For instance, gifts made in ‘contemplation of death’ or those given within two years prior to death were subject to scrutiny to prevent individuals from artificially reducing the value of their estate to avoid taxes.

- Despite its intentions, the Estate Duty Act faced several challenges during its existence:

- Complexity: The law was intricate and difficult to navigate, leading to higher litigation and administrative costs for both taxpayers and authorities.

- Perceived Double Taxation: There was a perception of double taxation on the same assets, as individuals felt that they were being taxed through both estate duty and wealth tax, which was later abolished from the fiscal year 2015-2016

- Tax Evasion: Estate duty collections were often lower than expected due to illegal concealment of assets and the prevalence of holding properties under benami (anonymous or proxy) names.

- These challenges contributed to widespread dissatisfaction with the estate duty system, ultimately leading to its abolition in India.

Status of inheritance tax in India

- Inheritance tax – Inheritance tax was a tax that was levied against a particular asset during the time of its inheritance.

- A person can receive inheritance either under a Will or under the personal law of the deceased.

- It comes under direct tax.

- Status of inheritance tax in India – In India, the concept of levying tax on inheritance does not exist now.

- The Inheritance or Estate Tax was abolished with effect from

- In the event of death of an individual, properties belonging to the deceased would pass on to his legal heirs, a transfer without any consideration in return.

- Hence, it could qualify as a gift for the purpose of income tax.

- The Income Tax Act, 1961, specifically excludes the transfer of assets under will or inheritance from the purview of gift tax.

When should the person receiving the inheritance pay tax?

- Income generated from inherited property must be taxed by the recipient, which includes any rental income or interest earned, once they assume ownership.

- Similarly, when the inherited asset is sold, capital gains tax applies.

- Whether these capital gains are considered long-term or short-term depends on the duration the property was held by both the heir and the deceased.

- Legal decisions have affirmed that indexation should be permitted, substituting the cost for the previous owner.

- Indexed capital gains are then subject to a uniform 20% tax rate.

- Indexation is a systematic process that enables individuals to protect their earnings against tax erosion.

- It allows individuals to adjust the cost of investment for inflation with the help of a price index.

Need for an inheritance tax in India

- Reduces inequality – It contributes to reducing inequality.

- Dispersion of wealth – It facilitates a more equitable distribution of wealth.

- Creation of meritocratic society – It fosters the establishment of a meritocratic society by diminishing the advantages enjoyed by the offspring of affluent families solely due to their birth circumstances.

- Utilitarian economics – It is grounded in the principles of utilitarian economics, which posits that redistributing initial resources can lead to an optimal societal condition.

- Need for more direct taxes – Given that a significant portion of India’s tax revenue is generated through indirect taxes, the burden on economically disadvantaged segments of society is heightened.

- Revenue to fund public welfare – Inheritance tax has the potential to generate substantial revenue for the government, which could then be allocated towards funding public welfare initiatives.

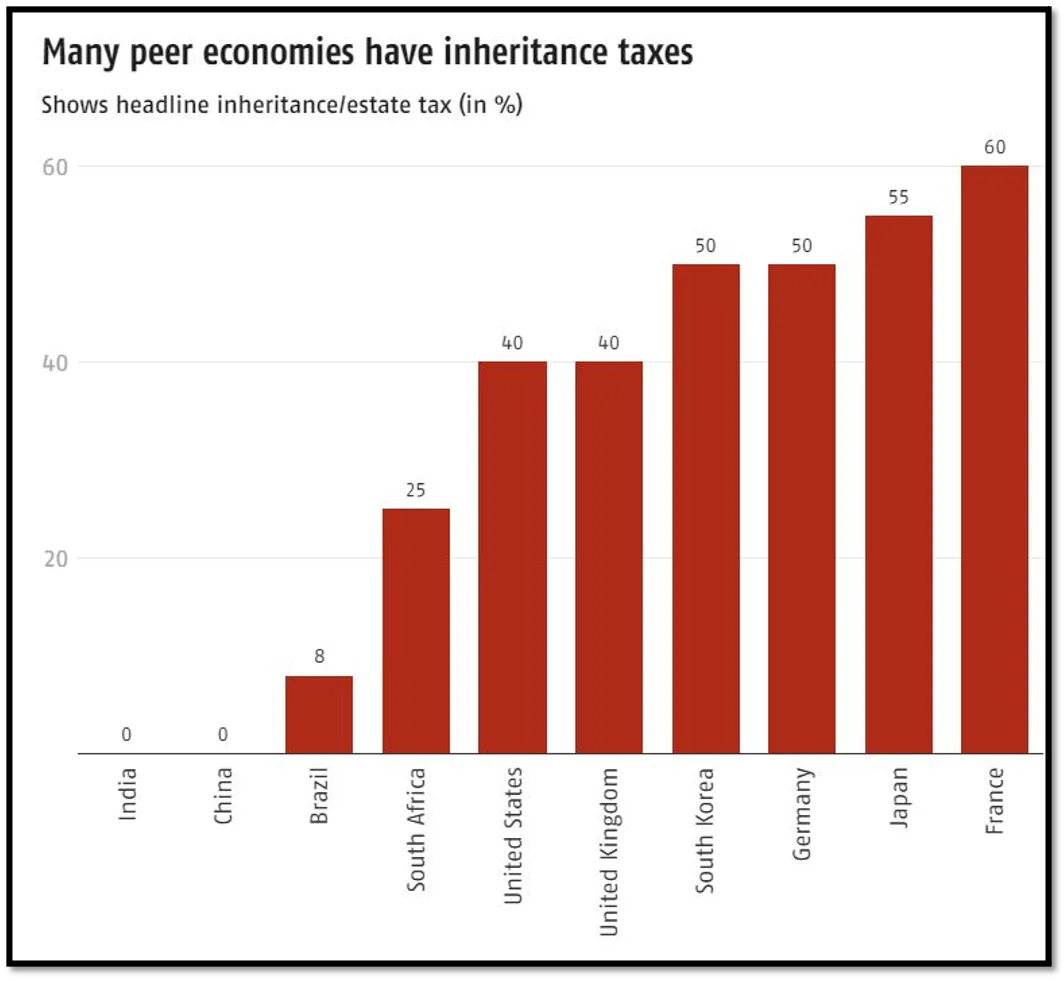

- International practices – Countries like England, France, Germany, the USA, and Greece have implemented inheritance taxes, some with rates as high as 40%, as part of their tax regimes.

Global Comparison

- International Prevalence: Inheritance tax is prevalent in countries like the UK, Japan, France, and Finland.

- US Scenario: In the United States, only six states have inheritance tax, indicating a varied approach within the country.

Disclaimer: The article may contain information pertaining to prior academic years; for further information, visit the exam’s “official or concerned website“.

Explore our courses: https://apnipathshala.com/courses/

Explore Our test Series: https://tests.apnipathshala.com/